TAKE ACTION: We are celebrating Social Security’s 80th birthday anniversary this month and want to note that this earned-benefit program has kept millions of older women and families with a deceased or disabled working parent out of dire poverty since its adoption in the mid-1930’s.Very nearly since the beginning of NOW’s 50-year history, we have advocated for the strengthening of the program, especially to benefit women and their families.

For too long, women have been left behind economically because of years taken out of the paid workforce to provide valuable yet unpaid caregiving services. The average retired woman receives $13,000 less to live on (income from all sources) each year than her male counterpart. This gender disparity is largely due to the fact that caregiving currently has no income value to be considered for future Social Security benefits. We know that very elderly women – widows, divorced or never-married – often spend their declining years primarily dependent upon their Social Security check.

Legislation has been proposed to credit caregivers of either sex for the time they take out of the paid workforce in the calculation of their Social Security retirement benefits. The proposed caregiver credit would increase women’s economic security in retirement by recognizing their caregiving work in calculating their Social Security benefits. NOW has set adoption of caregiver credit legislation as a top priority in our larger effort to improve benefits and assure long-term financial solvency for Social Security. We hope you will contact your U.S. Representative and urge her/him to co-sponsor and work for passage of this legislation.

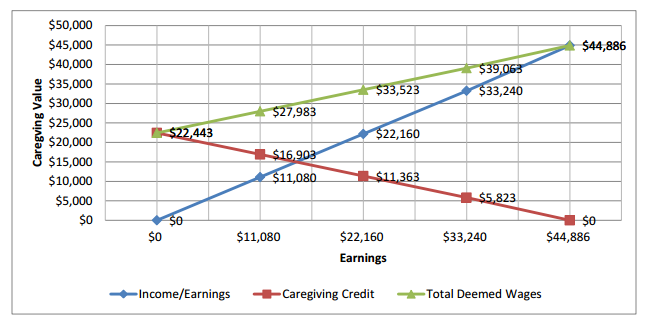

Caregiver Credits Increase Financial Security – The Social Security Caregiver Credit Act of 2015 (Rep. Nita Lowey, N.Y. – H.R.3377) would create a progressive Social Security credit which would be correlated with an income-based sliding scale providing lower-income workers with a proportionately larger credit, as shown in the chart below. This credit would be available

to anyone caregiving for at least 80 hours per month for up to 60 months and would be crucial to the economic security of caregivers who spend on average 4.6 years out of the labor force receiving no income, according to the Center for Community Change. No longer should these women be penalized for years spent caring for a dependent and foregoing paid full-time or part-time work.

Millions of Women Affected – To read more about how this legislation, if passed into law, would benefit working women and their families, see the report Expanding Social Security Benefits for Financially Vulnerable Populations, by the Institute for Women’s Policy Research (IWPR), the Older Women’s Economic Security Task Force of the National Council of Women’s Organizations (co-chaired by NOW and IWPR), and the Center for Community Change, http://www.iwpr.org/publications/pubs/expanding-social-security-benefits-for-financially-vulnerable-populations

Call, e-mail, or schedule a meeting with your representative and ask them to co-sponsor, support, and vote for the Social Security Caregiver Credit Act, H.R. 3377, sponsored by Rep. Nita Lowey. The main number for Congress is (202) 225-3131 and a directory of House member’s office numbers is available at http://www.house.gov/representatives/