Leave a Legacy for Women

You have the ability to build a feminist future. When you leave a gift to NOW or the NOW Foundation in your will or other estate plans, you are creating a proud legacy that will inspire tomorrow’s activists. Legacy gifts are crucial to the sustainability of our organization.

Since 1966, NOW has been a leader in promoting women’s rights. You can join this legacy of fighting discrimination and securing justice for women.

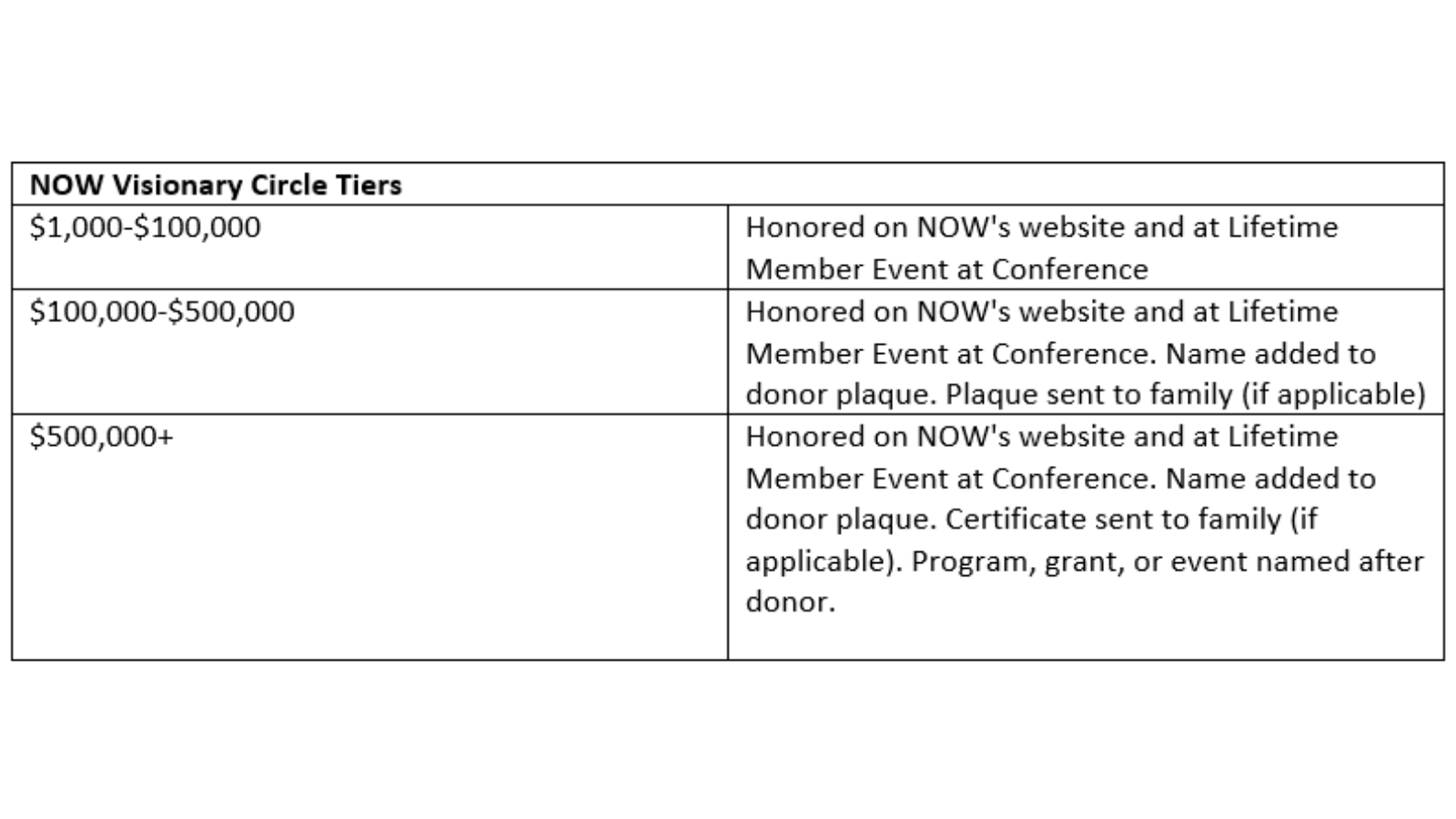

Join NOW’s Visionary Circle

Members of NOW’s Visionary Circle consist of dedicated supporters who have included NOW or the NOW Foundation in their estate plans as a lasting legacy to achieving equal rights for women and girls. Our Visionary Circle is designed to honor and recognize individuals who make this special commitment. If you have included NOW in your estate plans, informing us of those plans enables us to properly express our gratitude.

We look forward to welcoming you as a new member of NOW’s Visionary Circle! For more information, please call NOW’s fundraising department at 202-628-8669, ext. 119 or email fund@now.org.

NOW and the NOW Foundation — What is the difference?

NOW and the NOW Foundation are two separate but affiliated organizations. The goal of both organizations is to achieve equality and better opportunities for women and girls.

The National Organization for Women (NOW) is a 501(c)(4) non-profit organization that focuses on promoting six core values: reproductive justice and rights, economic justice, ending violence against women, racial justice, LGBTQIA+ rights, and constitutional equality through grassroots lobbying, political action, events, and programs. NOW is tax-exempt, but membership dues and donations are not tax-deductible.

The NOW Foundation is a 501(c)(3) non-profit organization that focuses on issues like economic justice, pay equity, racial discrimination, women’s health and body image, women with disabilities, reproductive rights and justice, family law, marriage equality, representation of women in the media, and global feminist issues through education and litigation. NOW Foundation is tax-exempt, and all donations are tax-deductible.

When deciding which type of legacy gift you wish to make, you should consider how important the tax benefits of your gift are to you and what impact you would like your legacy to have.

FreeWill

To help you get started on your plans and legacy, you can use FreeWill, an online tool that guides you through the process of creating a legally valid will or trust. Click here to review.

Simple Ways to Make Your Legacy Gift

Outlined below are just some of the many ways you can leave a bequest to NOW. Most gifts will cost you nothing now, and keep you in control of your assets during your lifetime.

As with any important financial decision, we recommend that you consult an attorney and/or financial advisor as you consider your options.

Make a Bequest in Your Will

Your will is a symbol of everything you value in your life. You can use your will to support NOW and a feminist future in the following ways:

- You may leave a specific amount of money or designated property to NOW.

- You may leave a specified percentage of your estate to NOW.

- Once all of your specific bequests are fulfilled to family and loved ones, you can designate that the remainder (residuary) of your estate go to NOW.

You can make your gift to NOW or the NOW Foundation. You can also make your bequest in memoriam of a loved one. Please see below for more information regarding these two separate but affiliated organizations.

Sample bequest language for your will:

I give, devise and bequeath the sum of $_______ (or _____% of my estate; or ______% of my residuary estate; or the following described property) to the National Organization for Women (or the NOW Foundation), 1100 H Street NW, Suite 300, Washington, D.C. 20005 (if applicable) in memoriam of X.

Designate Your Life Insurance Policy

You may choose to make NOW or the NOW Foundation a beneficiary of your current life insurance policy, a policy provided through your employer, or a life insurance policy that is either completely paid for or has outlived its original purpose.

If you donate a fully paid policy to the NOW Foundation, you may take a tax deduction equal to the replacement value of the policy. If you choose to purchase a policy or donate a policy for which you are still making premium payments, you may deduct the cost of the premium payments as a charitable contribution to the NOW Foundation.

Designate Your Retirement Plan

In many cases, your surviving heirs will have to pay estate taxes or income taxes on the inheritance of a retirement plan such as an IRA or 401(k), leaving only a fraction of these assets for their use.

Alternatively, you could list the NOW Foundation as a beneficiary of your retirement plan, which would preserve those funds free from taxes.

You can still provide for your loved ones by leaving them cash and other assets you own that will not be subject to the high taxes imposed on retirement accounts.

Important information for NOW:

- Full legal name: National Organization for Women, Inc.

- Permanent mailing address: 1100 H Street NW Suite 300, Washington, DC 20005

- Federal tax identification number: 23-7094479

- Date of Incorporation: February 10, 1967

Important information for the NOW Foundation:

- Full legal name: National Organization for Women Foundation, Inc.

- Permanent mailing address: 1100 H Street NW Suite 300, Washington, DC 20005

- Federal tax identification number: 52-1477004

- Date of Incorporation: July 25, 1986

For more information about these and other legacy giving options (including Totten Trusts, POD accounts, real estate, and more), please contact NOW’s fundraising department at 202-628-8669, ext. 119 or fund@now.org. The fundraising department also meets with legacies upon request.